End-to-end registrations, accounting, compliance, loans and insurance — structured for scale.

MSME registration to avail government benefits, subsidies and schemes.

Mandatory GST registration for businesses and service providers.

Business Registration Number (SAN) for local businesses.

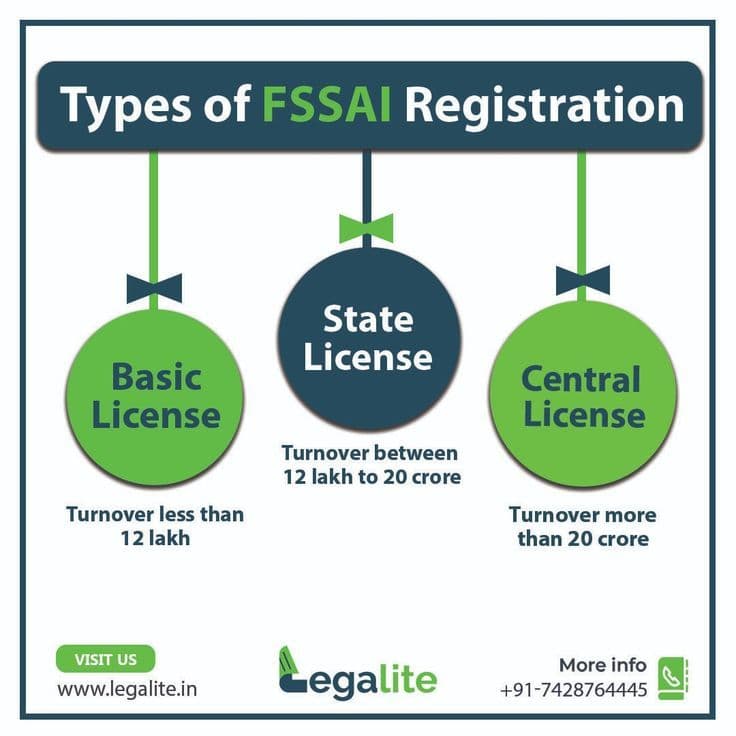

Basic FSSAI registration for small food businesses.

Employee State Insurance and Provident Fund registration.

Protect your brand name, logo and identity legally.

Digital signature for MCA, GST and income tax filings.

Seller account setup on Amazon, Flipkart and other platforms.

TAN & TDS registration for tax deduction compliance.

Startup India recognition with DPIIT benefits.

Government e-Marketplace registration for suppliers.

Mandatory registration for import-export businesses.

GST LUT filing for export without tax payment.

AD Code registration for export transactions.

DIN allotment for company directors.

Company incorporation certificate from MCA.

Annual ROC filings and company compliance.

FSSAI state license for medium-scale food businesses.

Central FSSAI license for large food manufacturers.

Labour department license for employers.

Municipal trade license for commercial activities.

Private Security Agency license under PSARA Act.

Day-to-day accounting, vouchers, ledgers and reconciliations.

Preparation of P&L, Balance Sheet and Cash Flow statements.

Accounting aligned with income tax and GST requirements.

Stock valuation and inventory management.

Project-wise accounting and cost tracking.

Multi-branch accounting and consolidation.

Accounting for contract-based businesses.

Accounting for job work and manufacturing units.

Accounting solutions for construction projects.

GST returns, audits, notices and reconciliations.

ITR filing, tax planning and assessments.

TDS/TCS returns and statutory compliance.

ROC filings and annual compliance.

Labour law registrations and filings.

Business loans for MSMEs to support working capital, expansion and growth.

Government-backed Mudra loans for micro and small businesses.

Funding solutions for startups through banks and NBFCs.

Short-term and long-term loans for business expansion.

Flexible overdraft facility for working capital needs.

Cash credit limits for smooth business operations.

Loan assistance under PMEGP government scheme.

Loans for women and SC/ST entrepreneurs.

Quick personal loans with easy documentation.

Loans for house construction and renovation.

Secured loans against residential or commercial property.

Loans for two-wheelers, cars and commercial vehicles.

Comprehensive and third-party car insurance policies.

Two-wheeler insurance with complete coverage.

Insurance for commercial vehicles and transport businesses.

Health insurance plans for individuals and families.

Coverage against accidental death and disability.

Life and term insurance plans for long-term security.